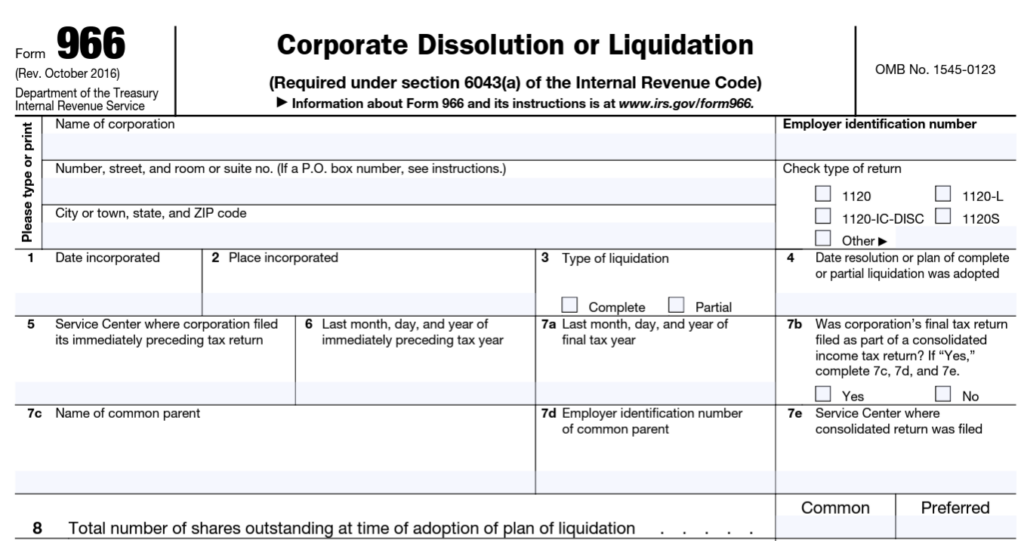

The Essential Guide for Form 966 for Corporate Dissolution or Liquidation

When moving through the process of corporate dissolution or liquidation, you need to ensure all your bases are covered to avoid unwanted penalties. One of the most important bases for completing this task is filing IRS Form 966.

The following guide includes everything you need to know about for closing your company:

Click here to view our complete guide on how to dissolve your corporation.

Read on to learn about filing IRS Form 966 when dissolving a corporation.

What is Form 966?

IRS Form 966, also known as the “Corporate Dissolution or Liquidation” form, is a document that must be filed with the Internal Revenue Service (IRS) when a corporation or a limited liability company (LLC) decides to dissolve or liquidate its business.

Why is Form 966 Important?

The primary purpose of Form 966 is to provide the IRS with information about the corporation or LLC that intends to dissolve or liquidate. It notifies the IRS that a corporation or LLC is in the process of dissolving or liquidating its business and allows the IRS to identify the final tax return. It is primarily an administrative requirement to inform the IRS about the cessation of operations.

However, the process of dissolution or liquidation itself can have tax implications that may result in potential tax savings or financial benefits. Here are a few scenarios where tax savings or benefits might arise:

- Loss Carry Forwards. If a corporation or LLC has net operating losses or other tax attributes, the liquidation or dissolution procedure may allow for the utilization of those losses to offset taxable income, resulting in a potential reduction of tax liability.

- Capital Losses. During the liquidation process, the sale of assets may result in capital losses, which can be used to offset capital gains.

- Distribution of Assets. When a corporation or LLC liquidates, its assets are typically distributed to shareholders or members. Depending on the nature of the assets and their tax basis, shareholders or members may benefit from favorable tax treatment, such as capital gains treatment for certain assets.

- Debt Forgiveness. If the corporation or LLC has outstanding debt that is canceled or forgiven as part of the dissolution or liquidation process, there may be potential tax benefits associated with the discharge of indebtedness income.

It’s important to note that the specific tax implications and potential benefits of dissolution or liquidation can vary based on factors such as the entity’s tax structure, the nature of its assets, and applicable tax laws.

Who is Required to File Form 966?

Corporations or limited liability companies (LLCs) that have formally decided to dissolve or liquidate their business are typically required to file Form 966. Here are some specific situations where filing Form 966 is necessary:

- Voluntary Dissolution. If a corporation or LLC decides to voluntarily dissolve or liquidate its business, Form 966 must be filed with the IRS.

- Involuntary Dissolution. In some circumstances, the state or a judge may involuntarily dissolve an LLC or corporation. If this occurs and the entity has not previously filed Form 966, it must do so within 30 days after the involuntary dissolution.

- Going Out of Business. If a corporation or LLC ceases its operations, sells off its assets, and winds up its affairs, it is considered to be going out of business. In such cases, Form 966 is typically filed to notify the IRS about the cessation of operations in these circumstances.

Form 966 is not required for all types of business closures. For example, sole proprietorships do not typically file this form. Additionally, entities undergoing bankruptcy proceedings may be subject to different reporting requirements.

Why Does My Company Need to File Form 966?

Form 966, also known as the “Corporate Dissolution or Liquidation” form, must be filed by any corporation or LLC that is dissolving or liquidating. Basically, it is a form that must be filed with the IRS to inform them that your business is shutting down. The form enables the IRS to track your final tax return and notifies them that your business is closing.

But here’s the kicker – dissolving or liquidating your business can have some tax perks too. You might be able to offset losses, benefit from capital gains treatment, or even catch a break on canceled debts. Also, remember the Form 966 deadline: this form must be submitted within 30 days of your business’s official closure. Sole proprietorships do not have to file. However, filing late or with errors can result in penalties and tax complications.

When is the Deadline for Form 966?

As mentioned above, Form 966 is due 30 days after closing the company. Please note that the date on the stamped dissolution documents is the date the company ceased to exist, thus the end of their tax year. The 30-day period starts when the entity formally adopts the resolution or plan.

Are There Penalties for Non-Compliance, Lateness, and/or Errors on Form 966?

Failure to comply with the requirements of Form 966, submitting the form late, and/or completing the form with errors may result in potential penalties or adverse consequences. Here are some important points to consider:

- Late Filing Penalties. If Form 966 is not filed within 30 days after the adoption of a resolution or plan to dissolve or liquidate, the IRS may impose penalties for late filing. The penalty amount may vary depending on the size of the corporation or LLC.

- Incomplete or Inaccurate Information. Providing incomplete or inaccurate information on Form 966 may result in penalties or additional scrutiny from the IRS. It is important to ensure that all required fields are completed and that the information provided is correct.

- Tax Liability and Audit Risk. Dissolving or liquidating a corporation or LLC involves finalizing tax matters, such as filing the final tax return and settling any outstanding tax obligations. Failing to address these tax issues properly may result in additional tax liabilities, interest, penalties, and potential audits.

- State Requirements. In addition to the IRS requirements, it is essential to comply with state-specific dissolution or liquidation requirements. Failure to meet these requirements may lead to penalties or legal complications at the state level.

What Documents are Required for Form 966?

Generally, when filing Form 966, you must provide certain information about the company, its assets, and its liabilities. While the form itself does not require specific supporting documents, it is important to maintain proper records and documentation to substantiate the information provided on Form 966.

What are the Related Forms of Form 966?

When filing Form 966, there are several related forms and documents that may be required, depending on the specific circumstances of the corporation or LLC. Here are some commonly associated forms:

- Final Income Tax Return. Form 966 does not replace the requirement to file a final income tax return for the corporation or LLC. Typically, Form 1120 or Form 1065 is used to file the final tax return for corporations and partnerships/LLCs. The final return covers the period from the date of dissolution or liquidation.

- EIN Cancellation Letter. After filing your final tax return and Form 966 with the IRS, you must also cancel your EIN with the IRS via the EIN Cancellation Letter. The EIN Cancellation Letter is an important document that acknowledges the business entity’s closure or dissolution and confirms the EIN’s cancellation. The employer identification number (EIN) assigned to your business entity is the permanent federal taxpayer identification number for that business. If it is not canceled, you are still liable to file a return for every year the EIN is active, regardless of whether the business is active or not.

- Form 1099-DIV or Form 1042/s. If the corporation or LLC makes distributions to its shareholders as part of the dissolution or liquidation process, Form 1099-DIV or Form 1042/1042-S may be required to report those distributions. Form 1099-DIV is used to report dividends and other distributions to shareholders.

- Form 982. Also known as “Discharge of Debt” or “Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment),” is a form used for reporting the exclusion of canceled debt from taxable income. When a debt is canceled or forgiven, it is generally considered taxable income. However, under specific provisions of the Internal Revenue Code, canceled debt may be excluded from taxable income in certain instances.

- Form 4797. When a corporation or LLC sells or disposes of assets during the dissolution or liquidation process, any resulting gains or losses are typically reported on Form 4797, “Sales of Business Property.” This form is used to report the sale or exchange of the organization’s assets.

- Form 1099-C. If the corporation or LLC cancels or forgives any outstanding debts during the dissolution or liquidation process, Form 1099-C may be required to report the canceled debt as taxable income to the debtor. Form 1099-C is used for reporting income from debt cancellation.

- State Dissolution Forms. In addition to federal forms, state-specific dissolution forms or documents may be required by the state where the corporation or LLC is registered. These forms can vary depending on the state’s regulations and may include certificates of dissolution, cancellation, or termination.

What Other Documents are Needed to Complete the Dissolution?

The following documents may be helpful during the dissolution process:

- Stamped Certificate of Dissolution. This is the document issued by the appropriate state authority when a corporation or LLC has completed the process of dissolution or liquidation. It serves as official evidence that the entity has been formally dissolved or canceled and no longer exists. The important element of this document is the Effective Date of Dissolution, which is the date when the state authority approves and processes the dissolution or cancellation filing.

- Articles of Dissolution or Liquidation. These are legal documents that formally state the decision to dissolve or liquidate the corporation or LLC. They typically outline the reasons for dissolution, the approval of shareholders or members, and other pertinent information. The articles of dissolution or liquidation may be required by the state in which the business is registered.

- Corporate Resolutions or Meeting Minutes. If the dissolution or liquidation decision was made through a corporate resolution or at a meeting of shareholders or members, it is advisable to keep copies of the resolutions or meeting minutes. These documents can serve as evidence of the decision-making process and the authority to dissolve or liquidate the company.

- Financial Statements. It may be helpful to gather financial statements, including balance sheets, income statements, and cash flow statements, as of the date of dissolution or liquidation. These financial statements can be used to file the final tax return and provide an overview of the company’s financial position at the time of its closure.

- Asset and Liability Documentation. As part of the dissolution or liquidation process, it is important to maintain records pertaining to the disposition of assets and settlement of liabilities. This includes documentation of asset sales, transfers, distributions to shareholders or members, debt repayments, and/or settlement records.

- Tax Records. Ensure you have access to all relevant tax records, including prior-year tax returns, estimated tax payments, and any tax-related correspondence with the IRS or state tax authorities. These records will be necessary for filing the final tax return and satisfying any tax obligations related to the dissolution or liquidation.

While the specific documents required may vary depending on the circumstances and state regulations, having a comprehensive set of records and documentation will help ensure accurate and complete reporting on Form 966 and compliance with tax and legal requirements.

Click here to view our complete guide on how to dissolve your corporation.

What are the Common Form 966 Errors?

When submitting Form 966, you must take care to avoid common errors that may result in processing delays or possible penalties. Here are some common errors to avoid when completing Form 966:

- Missing or Incomplete Information. The failure to provide all required information on Form 966 is one of the most frequent mistakes. Ensure that you fill out all fields accurately and completely, including the entity’s name, address, EIN, and details of the dissolution or liquidation. Given that Line 10 is the most important field on the form, it will be returned if it is left blank or incomplete.

- Incorrect Dates. Pay close attention to the dates you provide on Form 966. Ensure that the date of the adoption of the resolution to dissolve or liquidate, as well as the effective date of the dissolution or liquidation, are accurately recorded. Typically, they are identical for the purposes of the form. Ensure that the date of the adoption of the resolution to dissolve or liquidate, as well as the date of the resolution’s effective date, are entered accurately.

- Signature Issues. Form 966 must be signed by a duly authorized officer of the corporation or LLC. Ensure that the form is properly signed and that the signer’s information, including the title (which must be CEO, President, Officer, Partner, or Director), as well as the date of signing.

Can Cleer Tax Assist in Filing Form 966?

The last thing anyone wants after closing a company is to discover months or years later that the required forms were incorrectly filed. At Cleer, we make it simple, easy, and straightforward for you, ensuring that everything is properly taken care of. Let us handle your filing so that you can focus on your business and have peace of mind that all necessary details and requirements were provided accurately and completely.

Our Final Tax Package includes filing Form 966, a federal tax return, a state tax return, and your EIN cancellation letter. Because the final Certificate of Dissolution from your state of registration can sometimes take weeks to arrive, we offer an extension at no additional cost.

If you need legal assistance with the dissolution requirements, we can refer you to our legal partners, who offer a discounted package to guide our clients through the dissolution process, including board resolutions and articles of dissolution.

It is important to note that in order to dissolve a company, all tax filings must be current. With our Catchup Bookkeeping Service, Cleer Tax can help you with your prior years’ tax returns, financial statements, or simply getting months or years of books up to date to prepare for filing.