Choosing the proper tax classification for your business can be a headache, but fear not—the Cleer Tax ultimate guide to Form 8832 is here to save the day! This nifty tax form allows business owners to choose the tax classification that suits them best, whether it’s a C-corporation, a partnership, or a disregarded entity.

The best part? It’s not mandatory, so you have the power to decide when you want to make the switch. So, whether you’re dreaming of going from a C-corporation to a pass-through entity for those sweet tax benefits or just curious about your options, this article has all the details you need. Say hello to tax flexibility!

Each tax classification has implications for the entity’s and its owners’ tax liabilities and filing requirements. The entity’s tax classification also impacts the owners’ liability for business debts. Certain tax classifications provide owners with personal liability protection, preventing creditors from pursuing claims against their personal assets. Understanding these implications is crucial for businesses so they can select the most suitable tax classification that aligns with their financial goals, risk tolerance, and operational needs. Consulting with tax professionals at Cleer Tax can provide valuable guidance in this decision-making process.

Key Takeaways

- Entities can select the most advantageous tax classification for their needs by using Form 8832.

- Eligible businesses can choose to be taxed as a partnership, C-corporation, or disregarded entity by completing and filing Form 8832, Entity Classification Election.

- Form 8832 is optional, and there is no deadline.

- This form must be attached to the entity’s federal tax or information return for the election year. If the entity is not required to file a return for that year, all direct or indirect owners must include a copy of Form 8832 with their tax returns for the owner’s tax year, including the date the election took effect.

What is Form 8832?

Form 8832, Entity Classification Election, is a tax form that allows eligible entities to elect how they will be classified for federal tax purposes. Entities may change their default tax classification by filing Form 8832, except those electing to be taxed as S-corporations, which must file Form 2553 instead. In other words, eligible entities may elect to be classified as a C-corporation, a partnership, or a disregarded entity by using Form 8832.

Eligible Entities:

Eligible entities can choose their federal tax classification. Except for entities that are automatically classified as corporations, a business entity with at least two owners or members has the option of being classified as an association taxable as a corporation or a partnership, whereas a business entity with a single owner can be classified as an association taxable as a disregarded entity or as a corporation.

Form 8832 may be filed by limited liability companies (LLCs) and partnerships. Corporations are generally not eligible; however, certain categories of corporations below are considered eligible entities:

- An eligible entity that has previously elected to be an association taxable as a corporation by filing Form 8832.

- An eligible entity that has filed Form 8832 to be classified as a corporation can change its classification later.

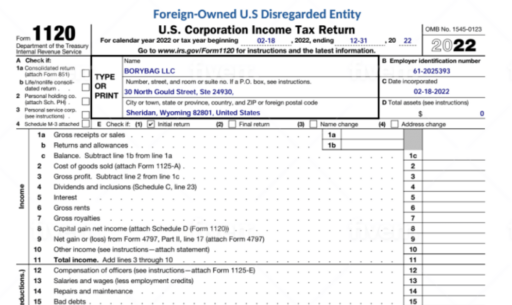

- A foreign-eligible organization that, due to the foreign default rule, became an association subject to corporate taxes.

Default Rules:

- Existing Entity Default Rule. Some domestic and foreign entities established prior to January 1, 1997 with a recognized federal tax status typically don’t require formal election to maintain their classification. Should such an entity opt to change its classification, it can do so subject to the 60-month limitation rule.

- 60-month Limitation Rule: Once an eligible entity has chosen to alter its classification, it is generally barred from making another classification change by election within the 60 months following the effective date of the initial election. However, if more than 50% of the ownership interests in the entity as of the election’s effective date are held by people who did not own any interests in the entity on the election’s filing date or effective date, the IRS may authorize the entity to change its classification by election during this sixty-month period through a private letter ruling. This 60-month restriction doesn’t apply if a newly formed eligible entity made the previous election and became effective on its formation date.

- Domestic Default Rule. This rule is applicable to an eligible domestic entity if it is:

- A partnership if there are two or more members.

- A disregarded entity if a single person owns it.

Notes:

- An eligible entity’s classification as an association is unaffected by a change in the number of members.

- The status of an eligible entity classified as a partnership is changed to that of a disregarded entity when the number of members becomes one.

- A disregarded entity is reclassified as a partnership once the number of members exceeds one.

- Foreign Default Rule. If Form 8832 is not filed to make an election, a foreign eligible entity is classified as follows:

- A partnership if it has at least two members, at least one of whom does not have limited liability.

- An association taxable as a corporation if all its members have limited liability.

- Disregarded as an entity separate from its owner if it has a single owner that does not have limited liability.

Why is Form 8832 Important?

Form 8832 enables business entities to select the most advantageous federal tax classification for the company and its shareholders or members. Each type of business has a default tax classification, but they can elect a different tax classification that provides different tax rates, deductions, and benefits. Entities that choose a new tax classification can reduce their tax liabilities while protecting personal assets from business creditors.

Certain tax classifications, such as partnerships, allow income to “pass-through” to the owners’ tax returns, preventing double taxation. Entities may choose these classifications to benefit from pass-through taxation and lower their overall tax burdens. In some cases, entities may need to change their tax classification to qualify for certain tax incentives. The IRS also uses the information you provide on this form to determine the entity’s federal tax filing and reporting obligations.

Who Has to File Form 8832?

Only eligible entities, such as domestic partnerships, domestic LLCs, and certain foreign entities, can file Form 8832 to elect their tax classification: C-corporation, partnership, or disregarded entity.

The following must file Form 8832:

- A domestic entity that chooses to be classified as an association taxable as a corporation.

- For purposes of Form 8832, an association is an eligible entity taxable as a corporation by election or, for foreign eligible entities, under the default rules (see Regulations Section 301.7701-3).

- A domestic entity electing to change its current classification (even if it is classified under the default rule).

- A foreign entity with more than one owner, all with limited liability, electing to be classified as a partnership.

- A foreign entity with at least one owner that does not have limited liability, electing to be classified as an association taxable as a corporation.

- A foreign entity with a single owner having limited liability electing to be classified as disregarded entity.

- A foreign entity electing to change its classification, even if it is now classified under the default rule.

What Information Do I Need to File Form 8832?

Before filing Form 8832, make sure you have the following information:

- Basic details about the entity, including its name, address, and phone number.

- Employer identification number (EIN); without the EIN, the business should file form SS-4 before filing Form 8832.

- The tax year for which the election is made.

- If a single person owns the eligible entity, you must give their name and identification number (social security number, individual taxpayer identification number, or EIN). If a disregarded entity or an entity that is a member of a series of tiered disregarded entities owns the electing eligible entity, you must specify the first entity (the one closest to the electing eligible entity) that is not a disregarded entity.

You must keep the books or records pertaining to a form or its instructions on file for as long as their contents may be relevant to any Internal Revenue law administration.

When is Form 8832 Due?

Form 8832 has no deadline. It can be filed when the business first started or at any time during the business’s lifetime; however, the filing date is important because it determines when the election will take effect. When you elect a tax classification for your company using Form 8832, it can’t go into effect more than 75 days before you file the election. Similarly, it can’t take effect later than 12 months after you file it. However, you might be able to get relief for filing your election late in the following situations:

- Either the entity did not obtain its requested classification on the date of formation (or when the entity’s classification became relevant), or the entity did not obtain its requested change in classification because Form 8832 was not filed on time.

- The due date for the entity’s federal tax or information return for the first year for which the election was intended has not yet passed; as a result, the entity has not submitted any such returns.

- The entity has reasonable cause for failing to make the entity classification election on time.

- Three years and 75 days from the requested effective date of the eligible entity’s classification election have not passed.

To qualify for its requested tax classification, an entity must have filed all necessary federal tax and information returns on time or within six months after the due date (excluding extensions), consistent with the chosen classification for the intended years. Additionally, no conflicting tax or information returns should have been filed for the entity during those years. If the entity isn’t required to file federal returns, individuals associated with it must also have filed their returns consistently with the entity’s requested classification without any inconsistencies.

Where is Form 8865 Filed?

Form 8832 must be attached to the entity’s federal tax or information return for the tax year of the election. If the entity doesn’t have to file a return for that year, all direct or indirect owners must attach a copy of Form 8832 to their tax returns for the owner’s tax year, including the date on which the election took effect. However, if an entity in which it has an interest is already filing a copy of Form 8832 with its return, an indirect owner of the electing entity is not required to attach a copy of Form 8832 to its tax return.

Form 8865 should be filed depending on the address of the business. Below is a guide to where to mail the form:

Where Can I Find the Most Recent Version of Form 8832?

You can access the most recent version of Form 8832 and instructions at this link.

Are There Penalties For Not Filing or Late Filing Form 8832?

There are no penalties for not filing or late filing Form 8832; the business will retain its default tax classification. The IRS has issued Revenue Procedure 2009-41, which provides relief to eligible entities who make a late entity classification election. The relief remains in effect for a period of three years and seventy-five days subsequent to the specified effective date of the classification election. When filing late, the eligible entity submits a statement explaining the reason for its failure to make an election on time. Then, the IRS will notify the entity if the relief is granted.

What Happens If I Don’t File Form 8832?

Entities not filing Form 8832 will be taxed according to their default tax classification, which could affect their tax liabilities and filing requirements. Filing Form 8832 is not mandatory; you don’t have to file it if you do not want to change your tax classification.

Default Tax Classification of Entities:

- Domestic Entities

- A limited liability company (LLC) with a single member is considered a disregarded entity for federal income tax purposes, but it is considered a separate entity for employment and certain excise taxes.

- An LLC with two or more members is treated as a partnership for federal income tax purposes.

- Corporations are automatically classified as C-corporations.

- Foreign Entities

- Foreign entities with two or more members and at least one that does not have a limited liability are treated as partnerships.

- Foreign entities are treated as corporations if all the members have limited liability.

- Foreign entities owned by single owners are classified as disregarded entities.

How Long Does It Usually Take to Complete and File Form 8832?

Completing and filing this form may take different amounts of time, depending on your specific situation. The estimated average time to fill out Form 8832 is 7 hours and 10 minutes.

Here is a breakdown of the time it takes to complete and file the form:

- Record keeping: 2 hours and 46 minutes

- Learning about the law and the form: 3 hours and 48 minutes

- Preparing and sending the form to the IRS: 36 minutes

Moving Forward with Form 8832

Navigating the complexities of tax classification for your company is an important step toward maximizing tax benefits and complying with IRS regulations. Form 8832 is an valuable tool in this process, allowing eligible entities to select the classification that best suits their operational and financial objectives. Whether aiming to maximize tax savings, protect personal assets, or enhance operational flexibility, understanding the implications of each tax classification is paramount. Before deciding on your company’s tax classification, you must weigh the distinct benefits and drawbacks of each (in terms of taxes, deductions, credit eligibility, and liability protection), legal requirements, and operational flexibility.

Need Help with Filing Form 8832? Cleer Tax is Here For You!

If you have any questions about the right tax classification for your company, schedule a consultation with one of the experts at Cleer Tax to discuss it further. Because incorrectly filing this form can have long-term implications, preparing it without subject-matter expertise is risky. We can file this form for you for a small, flat fee. We also offer comprehensive all-in-one monthly accounting packages that include monthly statements as well as your federal and state tax returns.

No matter what you need, Cleer Tax is here to help. You may contact our customer success team at hello@cleer.tax