Starting a business is many things: exciting, fun, challenging, and humbling. We’ve been there!

You pour your heart and soul into your new endeavor because you want your “baby” to succeed more than anything. Knowing your numbers, such as your cash flow and profit margin, are vital to your business growth.

Don’t leave your books as an afterthought, and save yourself months of work by having your bookkeeping system correctly set up from day one.

We’re here to get you started on the right foot.

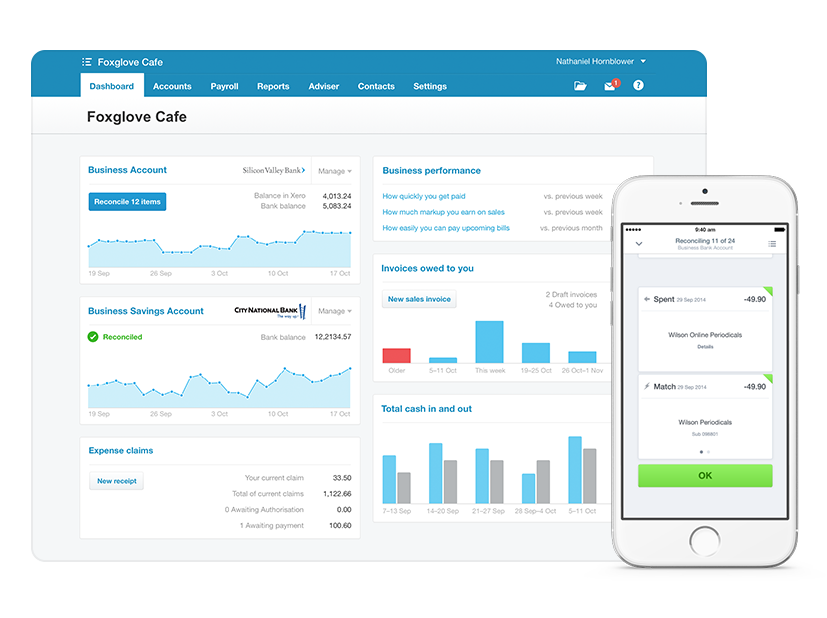

After we’re done, you will have a fully configured Xero setup, a fully customized chart of accounts, and answers to any questions you have about your new accounting system.

You’ll have all the tools, and your numbers at your finger tips, so you can better manage your business going forward.

We know what it’s like to be a startup or early-stage company, so we can do the initial setup of your books, and then let you run with it. This way there’s no ongoing cost, just the one-time setup fee.

And when you are ready for a long-term bookkeeper, Cleer Tax is here to help!

Our simple 4-step process is both streamlined and flexible to adjust based on your needs.

We kick off by setting up your Chart of Accounts in Xero, a top-notch online accounting software system. This lays the foundation for your financial journey.

Next, we make data upload a walk in the park. Whether it’s connecting your accounts online or uploading CSV files from your banks or credit card companies, we’ve got you covered.

Our meticulous team dives into categorizing every transaction. While some are straightforward, others may need your input to ensure they’re correctly placed.

By the end of this process, you’ll have a pristine financial setup in Xero, ready to empower your business.

The Accelerator Level is a more comprehensive package that includes additional services such as an advanced one-on-one consultation, election filing, and Estimated Tax Projections. The Incubator Level is designed for startups that are just starting out and need basic bookkeeping and tax support.

Yes, you can upgrade from the Incubator Level to the Accelerator Level at any time. We will prorate the difference in price and adjust your monthly subscription accordingly.

The Xero setup usually takes 2-3 business days to complete once we receive all the necessary information from you. We will need your assistance linking your various bank accounts (since we cannot access them).

The initial one-on-one consultation will be conducted by one of our experienced advisors. We will schedule a time that works for you and provide you with a list of topics to choose from, including tax planning, fundraising, financial modeling, and exit planning. During the consultation, you will have the opportunity to ask questions and receive personalized advice tailored to your specific situation.

Yes, the Incubator Level is suitable for all business types and sizes, including sole proprietors, partnerships, LLCs, and corporations.

The Incubator Level Package lasts for 12 months.

Yes, you can cancel the Incubator Level Package anytime. However, after we have set up your Xero account and held the consultation refunds are not available.

Xero is a cloud-based accounting software that helps you keep track of your business finances. We will set up your chart of accounts and show you how to add your bank accounts so that the data can be automatically imported into the software. Once it’s all set up the transactions need to be reconciled each month. For the Incubator Level package, you will do this from the start. For the Accelerator Level package, we will do the reconciliation for the first 3 months. For both levels, we will cover the cost of the software for 3 months.

Tax preparation is not included in these packages, however, we would be happy to file your taxes for you, but there will be an additional fee.

8832 election is the election made for the type of tax entity. Founder/s can choose between a corporation, partnership or disregarded entity.

The election allows for the taxes to be paid (if any) when shares are granted instead of the date when the shares actually vest. This can produce significant tax savings when shares vest in the future at a higher price. This election needs to be made within 30 days of the grant date.

Cleer Tax provides flat-rate accounting services for U.S. startups, often with foreign ownership, and growing businesses, to do it right from the start. Our all-inclusive accounting packages provide tax preparation, and bookkeeping to fit any budget and growth stage. Our tech-forward, streamlined process provides the Cleer path to success for your startup.

© 2024 Cleer Tax, LLC. All Rights Reserved · Privacy Policy · Terms & Conditions · Website by ModernTraction.com