Welcome to our comprehensive guide on Form 6765, your key to unlocking the potential tax benefits of Research and Development (R&D) tax credits. As businesses strive for innovation and technological advancement, understanding and utilizing these credits can significantly impact your bottom line. Whether you’re a startup pushing the boundaries of industry norms or an established corporation investing in groundbreaking research, navigating the complexities of Form 6765 is essential to maximizing your tax advantages.

Key Takeaways

- Payroll and contractors must be based in the U.S. to qualify.

- C-corporations, S-corporations, Sole Proprietors, and Partnerships must file Form 6765 to claim R&D credits.

- R&D credits can be used to reduce payroll taxes (under certain conditions) or to increase an assessed loss by offsetting federal income tax liability.

What Is the Purpose of Form 6765?

IRS Form 6765, officially known as Credit for Increasing Research Activities, is used to (1) calculate and claim the credit for increasing research activities, (2) elect the reduced credit under Section 280C, and (3) elect to claim a certain amount of the credit as a payroll tax credit against the employer portion of social security taxes.

What Are R&D Tax Credits?

R&D tax credits are government incentives designed to encourage businesses to invest in research and development. R&D tax credits are a reliable means of reducing income tax liabilities for companies involved in developing new or improved products, processes, formulas, or inventions.

Who Can Claim R&D Tax Credits?

All business organizations that incur expenses on specific activities to develop new or improved products, processes, software, techniques, formulas, or inventions on U.S. soil are eligible for R&D tax credits.

Similarly, under the Protecting Americans from Tax Hikes (PATH) Act of 2015, R&D tax credits are available to new and small businesses with less than $5 million in gross receipts for the credit year and no more than 5 years of generating gross receipts, including the credit year. For a period of up to five years, eligible businesses may deduct the R&D tax credit from their payroll taxes up to a maximum of $500,000 per year (up from $250,000 under Provision 13902 of the IRA of 2022).

Furthermore, PATH allows eligible small businesses to use the research tax credit to offset the alternative minimum tax (AMT), provided they meet the following criteria:

- The business entity is either a sole proprietorship or a partnership.

- A corporation whose stock is not traded publicly.

- The sole proprietorship, partnership, or corporation’s average annual gross receipts (less returns and allowances) had to be $50 million or less over the previous three years to satisfy the requirements. Gross receipts must meet the definitions in Sections 448(c)(2) and (3), as well as Regulation Section 1.448-1T(f)(2)(iv).

What Is a Payroll Tax Credit Election?

The IRS refers to a “payroll tax credit election” as an annual election made by a qualified small business (QSB) that specifies the amount of research credit that can be applied against payroll tax liability for tax years beginning after December 31, 2022. The credit is the smallest of the following: current year research credit, an elected amount not to exceed $500,000 (from $250,000), or the general business credit carryforward for the tax year (before the application of the payroll tax credit election for the tax year).

The limitation on general business credit carryforward is not applicable to S corporations or partnerships. The election must be made prior to the income tax return’s due date (including extensions). An election cannot be made for a tax year if it was made for five or more preceding tax years. A payroll tax credit election can only be revoked with the IRS’s permission.

Qualified Small Business Payroll Credit for Increasing Research Activities

- Maximum Payroll Tax Research Credit

Provision 13902 of the IRA of 2022 increased the maximum payroll tax research credit that a QSB may apply against payroll tax liability from $250,000 to $500,000 for tax years beginning after December 31, 2022. - Manner of Application

The IRA also amended IRC 3111(f) to allow a portion of the payroll tax credit to be applied to the employer’s Medicare tax, as mandated by IRC 3111(b). As a result, beginning in the first quarter of 2023, the payroll tax credit will be used first to reduce the employer’s share of social security tax by up to $250,000 per quarter, beginning with the first calendar quarter following the date the income tax return reflecting the election is filed.

Any unused credit is applied to the employer’s share of Medicare tax for the quarter. Any remaining credit is carried forward to the following quarter after deducting the employer’s share of Social Security and Medicare taxes. Form 8974 is used to calculate the amount of the payroll tax credit that can be claimed in the current quarter, which begins with the first calendar quarter following the date the income tax return reflecting the election is filed. - Treatment of all Members of the Same Controlled Group

For purposes of the payroll tax credit election, all members of the same controlled group are treated as a single taxpayer. As a result, the total gross receipts of all members of such a group must be considered when determining whether a business is a qualified small business.

What Is a Qualified Small Business Stock Exclusion?

The Qualified Small Business Stock Gains Exclusion, also known as Section 1202, is a tax break that allows non-corporate taxpayers to deduct some or all of the gain realized on the sale of qualified small business stock (QSBS) held for at least 5 years prior to sale from federal income tax. The maximum gain that is exempt from taxation under Section 1202 is $10 million, or ten times the adjusted basis of the stock that the taxpayer sold during the year. The term “adjusted basis” refers to a significant change in the recorded initial cost of an asset or security after it has already been owned.

What Are the Key Requirements That Must Be Met to Qualify As a QSB Under Section 1202?

The following are the primary requirements for a corporation to be classified as a qualified small business:

- Domestic Corporation: The corporation must be a domestic (U.S.) C-corporation. S-corporations and entities taxed as partnerships do not qualify. Businesses in the hospitality, personal services, financial sector, farming, and mining industries do not fall under the QSB category.

- Active Business: The corporation must be an active business, which means that it must primarily operate in a specific trade or business. It should not be primarily involved in activities such as investing, holding, or managing assets.

- Gross Asset Test: At the time the stock is issued, the aggregate gross assets of the corporation (including those of any predecessor) must not exceed $50 million.

- Aggregate Gross Asset Test After Stock Issuance: Immediately after the stock is issued, the aggregate gross assets of the corporation (including those of any predecessor) must not exceed $50 million.

- Five-Year Holding Period: In order to be eligible for the potential capital gains tax exclusion or reduction, the taxpayer must hold the qualified small business stock for at least five years.

- Original Issuance: The taxpayer must acquire the stock at the time of its original issuance, either directly from the corporation or through an underwriter.

- Active Business Requirement After Stock Issuance: The corporation must continue to meet the active business requirement for the stock for substantially the entire holding period of the taxpayer. Furthermore, the tax benefits and eligibility criteria for QSBS are subject to specific limitations and conditions. As a result, if you are considering taking advantage of QSBS tax incentives, we can provide you with the most up-to-date and accurate information based on the most recent tax laws and regulations.

How Does One Complete Form 6765?

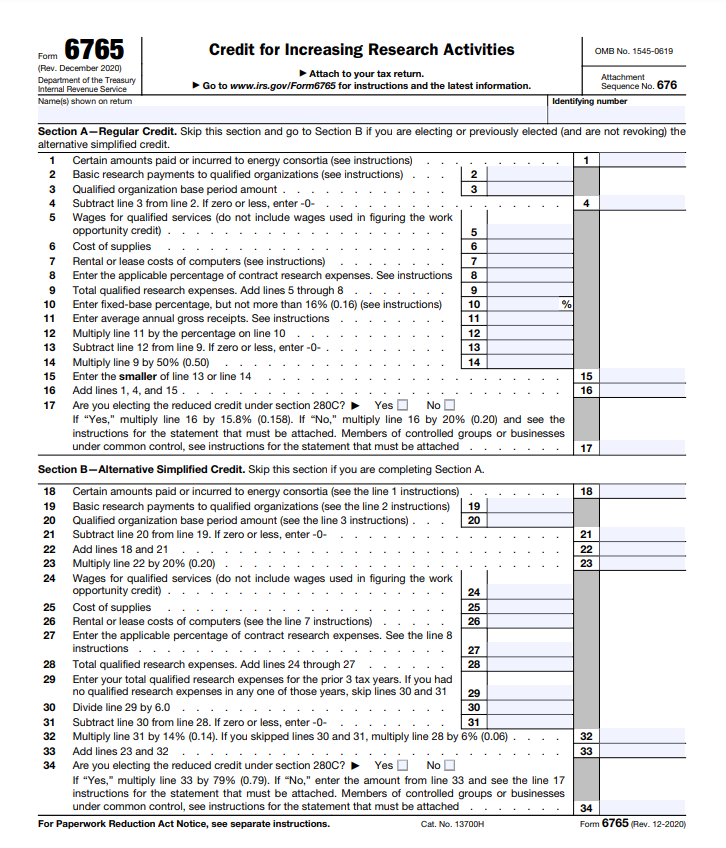

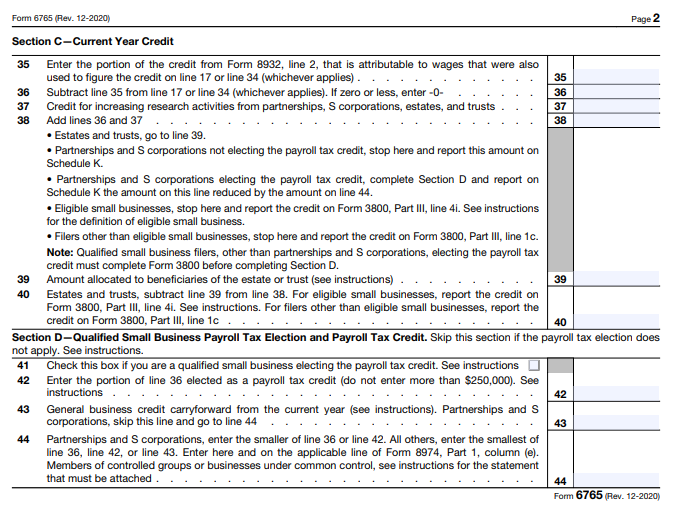

The IRS Form 6765 is divided into four sections. There are two methods for calculating R&D tax credits: the regular method (complete Section A) and the alternative simplified credit method (complete Section B). Determine which of the two methods is more beneficial or will give you more tax credits. You can do either of the two, but not both. The election made applies to the current tax year and all subsequent years until revoked in later years.

Here’s an example of how to fill out Form 6765, where the business entity used the regular method to calculate its R&D tax credits. ABC Inc., a C-corporation, has a qualifying research expenditure of $20,000. The $20,000 is made up of the following items:

- $10,000 in qualifying wages;

- $5,000 in qualifying supplies;

- $2,500 in computer rental or lease;

- $2,500 in qualifying contract research expenses:

ABC Inc. meets the small business definition and has elected to take advantage of the payroll tax credit. See the completed form below:

Where Can I Get the Most Recent Version of Form 6765?

The IRS website has the newest version of the form 6765. Check back frequently because the forms are updated on a regular basis, and the filing rules can change.

When Is the Form 6765 Due?

Form 6765 must be filed along with your income tax return by the extended due date for that year’s tax return. If your tax year ends in December, you must file Form 6765 with your return by April 15th or October 15th if you filed an extension. Attach it to your Form 1120 if you are a corporation; if you are a sole proprietor, attach it to your Schedule C and Form 1040.

S-corporations and Partnerships with fiscal years ending December 31 must file Form 1120-S and Form 1065 by March 15 or, if an extension was requested, September 15.

Why Do Most Firms Offer R&D Tax Credits On a Percentage-Based Fee?

Firms that prepare R&D tax credits on a percentage-of-savings basis do ONLY that – prepare the form. They do not prepare your return, nor do they sign it, and they bear no responsibility for incorrect preparation or lack of due diligence because the form is typically filled out by AI bots.

Think about this: if the fee is based on the size of the credit, those firms have a financial incentive to inflate the savings, but if the IRS audits the return, they have no liability. You have no other choice but to pay the penalty. At Cleer Tax, we do not accept Form 6765s prepared by other firms for this reason. We do offer a flat-rate R&D Tax Credit based on the number of components rather than the size of the credit. We also sign the return and guarantee the quality of our work.