What is the FinCEN Beneficial Ownership Form?

Starting January 1, 2024, FinCEN, the U.S. Treasury’s Financial Crimes Enforcement Network, will require companies to report their beneficial ownership information about the individuals who directly or indirectly own or control a company. “Reporting companies,” both domestic and foreign, are required to report their beneficial ownership information to FinCEN. The FinCEN Beneficial Ownership form will collect individuals’ names, dates of birth, residential addresses, and copies of government-issued identification.

Key Takeaways:

- FinCEN will require companies to report information about “beneficial ownership” who owns or controls a company starting January 1, 2024.

- A beneficial owner is any individual who: directly or indirectly exercises “substantial control” or owns or controls 25 percent or more of the company.

- This filing is required by the Corporate Transparency Act of 2021, enacted at the Federal level, as not all States require companies to disclose who owns or controls the entity.

- FinCEN aims to diminish U.S. corporate entities’ misuse to evade sanctions and other crimes.

Read on to find the answers to the top questions surrounding the FinCEN Beneficial Ownership form.

What is the FinCEN Beneficial Ownership Information Reporting Rule?

Financial Crimes Enforcement Network (FinCEN) issued a rule to implement beneficial ownership information reporting provisions of the Corporate Transparency Act (CTA). This rule aims to protect national security, prevent money laundering, and assist law enforcement in targeting illicit actors who use shell companies to conduct illegal activities in the United States.

Recent events, like Russia’s invasion of Ukraine, highlighted the need to combat the misuse of corporate entities to evade sanctions and other crimes, which is what led to the requirement of the FinCEN Beneficial Ownership form. The rule specifies who should file a FinCEN Beneficial Ownership report, what information to include, and the reporting deadlines, seeking to minimize burdens on small businesses.

What is Beneficial Ownership Information?

Beneficial ownership information reported on the FinCen Beneficial Ownership form refers to identifying information about the individuals who directly or indirectly own or control a company.

Who is a Beneficial Owner of a Reporting Company?

In general, a beneficial owner is any individual who:

- directly or indirectly exercises “substantial control” over the reporting company, or

- directly or indirectly owns or controls 25 percent or more of the “ownership interests” of the reporting company.

Whether an individual has “substantial control” over a reporting company depends on the power they may exercise over said reporting company. For example, an individual will have substantial control of a reporting company if they direct, determine, or exercise substantial influence over important decisions the reporting company makes.

In addition, any senior officer is deemed to have substantial control over a reporting company. Other rights or responsibilities may also constitute substantial control. “Ownership interests” generally refer to arrangements that establish ownership rights in the reporting company, including simple shares of stock.

Why Do Companies Have to Report Beneficial Ownership Information to the U.S. Department of the Treasury?

Only a few U.S. states require companies to reveal who actually owns or controls them. This lack of transparency lets criminals and corrupt individuals hide their identities and launder money through shell companies, which isn’t fair to honest American businesses. It also makes it tough for law enforcement to track down and prosecute these criminals.

To tackle this issue, Congress passed the Corporate Transparency Act in 2021. Under this law, certain U.S. and foreign companies must report information about their owners to FinCEN, the Treasury Department’s Financial Crimes Enforcement Network. FinCEN’s job is to protect the U.S. financial system from illegal activities. Collecting and sharing this information with the FinCEN beneficial ownership form makes it more challenging for bad actors to hide their ill-gotten gains.

What Companies Will Be Required to Report Beneficial Ownership Information to FinCEN?

Certain companies — referred to as “reporting companies” — are required to report their beneficial ownership information to FinCEN. There are two types of reporting companies: domestic reporting companies and foreign reporting companies.

A domestic reporting company is defined as a corporation, a limited liability company, or any other entity created by filing a document with a secretary of state or any similar office under the law of a state or Native American tribe.

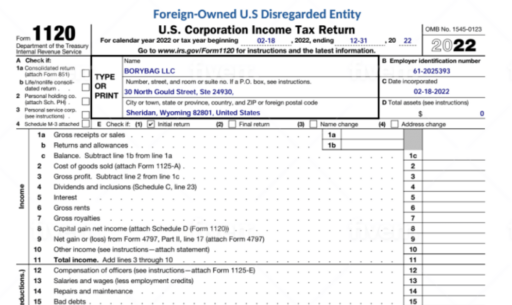

A foreign reporting company is any entity that is a corporation, limited liability company, or other entity formed under the law of a foreign country AND registered to do business in any U.S. state or in any Tribal jurisdiction created by filing a document with a secretary of state or any similar office under the law of a U.S. state or Native American tribe.

If you had to file a document with a secretary of state to create your company or register it to do business as a foreign company, then your company is a reporting company unless an exemption applies.

What Will a Reporting Company Have to Report About Its Beneficial Owners and Company Applicants?

For each individual who is a beneficial owner or a company applicant, with direct or indirect interest of 25% or more, a reporting company will have to report:

- The individual’s name, date of birth, and address.

- A unique identifying number from an acceptable identification document.

- The name of the state or jurisdiction that issued the identification document.

- For a beneficial owner, the reporting company must report the residential street address.

- Identification document from a government body or agency.

In addition, the reporting company must submit an image of the identification document associated with the unique identifying number reported when filing the FinCEN Beneficial Ownership form.

In Addition to Information About Its Beneficial Owner(s), Will a Reporting Company Need to Report Any Other Information?

Yes, other information may need to be reported when filing the FinCEN Beneficial Ownership form. However, this will depend on when the company was created or registered:

- If a reporting company is created or registered on or after January 1, 2024, the reporting company will need to report information about itself, its beneficial owners, and its company applicants.

- If a reporting company was created or registered before January 1, 2024, the reporting company only needs to provide information about itself and its beneficial owners. The reporting company does not need to provide information about its company applicants.

When Do I Need to File my Reporting Company’s FinCEN Beneficial Ownership Form?

A reporting company created or registered to do business before January 1, 2024 will have until January 1, 2025 to file its initial beneficial ownership information report form. The FinCEN Beneficial Ownership form was not accepted before the start of 2024.

A reporting company created or registered on or after January 1, 2024 will have 30 days to file its initial beneficial ownership information report. This 30-day deadline runs from the time the company receives written notice that its creation or registration is effective or after a secretary of state or similar office first provides public notice of its creation or registration, whichever is earlier. This means the deadline for 2024 and future years will be January 30th, as the laws are currently written.

What Entities are Exempt?

Exempt entities are those that are already regulated by federal and/or state government, like securities, finance firms, and banks; many already disclose their beneficial ownership information to a governmental authority, like utilities.

Here are more qualifying elements of exempt entities:

- Large operating companies with at least 20 full-time employees, more than $5,000,000 in gross receipts or sales, and an operating presence at a physical office within the United States.

- Certain types of inactive entities that were in existence on or before January 1, 2020, the date the Corporate Transparency Act was enacted.

What Information Will Be Reported on the New FinCEN Beneficial Ownership Form?

To prepare for information reporting, familiarize yourself with the items they intend to include on the new FinCEN Beneficial Ownership form. Here is the information that FinCEN plans to ask for with Beneficial Ownership reporting:

- Legal name

- Tax identification number

- Country (if foreign tax ID only)

- State of first registration

- Address

- Company applicant’s name, date of birth, address, and copy of government-issued ID

- Beneficial Owner FinCEN ID, name, date of birth, address, and copy of government-issued ID

Can Cleer Tax File my FinCEN Beneficial Ownership Information Reporting?

YES! Cleer Tax ensures tax filing compliance and compliance with all agencies, including FinCEN for foreign bank accounts and the BEA, such as the BE-12 and BE-13. For more information, email customer success at hello@cleer.tax.