Key Takeaways For Starting a Business In California:

- Thriving Metropolitan Areas: Small business owners in California may benefit from operating in populous and dynamic metropolitan areas such as Los Angeles, San Francisco, and San Diego – where access to a large customer base, diverse markets, and potential business collaborations are accessible.

- Challenging Tax Environment: California’s business tax structure has the potential to create financial challenges for small business owners. The state imposes high state income taxes on both business and personal income. Small business owners who operate as pass-through entities, like S corporations or LLCs, face the burden of being taxed on both their personal income and their business income, which can create additional financial strain.

- Double Taxation Impact: California’s small business owners face double taxation. While the federal government generally avoids double taxation for pass-through entities, California is one of the few states that taxes both the business owners and the business itself. This creates the potential for many negative financial implications for small businesses.

- Tax Planning and Compliance: Given the complex tax environment in California, small business owners must use diligence in tax planning and ensure compliance. Seeking professional advice from tax experts familiar with California’s tax laws can help minimize tax burdens and avoid penalties.

What do I need to do if I want to start a business in California?

- Choose an Entity Type and Business Name – The choice of entity type will have an effect on how the business and partners/shareholders will be taxed. It may be necessary to register the entity with the California Secretary of State, depending on the entity type.It is advisable to meet with a tax expert, accountant or attorney to discuss the best entity type for your business plan.

- Register the Business – Forms for corporations, LLCs and Limited Partnerships (LPs) are available on the Secretary of State online portal. If a business chooses to do business under another name other than the business’ legal name, or DBA (Doing Business As), “fictitious” business names should be filed with the county clerk/recorder where the business is located.

- Obtain Specialty Licenses and Permits – Once the business entity is registered with the California Secretary of State, the business must obtain the necessary licenses and/or permits to operate, depending on the product or service. The CalGold website has information on business license and permitting requirements.

- Learn Employer Responsibilities – If the business will hire employees or independent contractors, it must obtain a Federal Employer Identification Number (FEIN) and register as an employer with the department of labor. There are obligations such as payroll taxes, wage withholding, and employee employment eligibility requirements, along with State Disability insurance (workers’ compensation), and unemployment insurance. These can be handled by using a payroll company that will also take care of quarterly filings.

- Review Ongoing Registration Requirements – Every corporation and LLC is required to file a Statement of Information with the California Secretary of State within the first 90 days of registering in California. California Stock Corporations and Foreign (formed outside of California) Corporations must register annually. Nonprofit Corporations and LLCs must register every two years, based on the calendar month of the entity’s registration date. Corporations and LLCs can file the required Statement of Information online using the bizfile portal.

- Secure Financing – Financing a startup business may be costly, requiring personal savings, secured loans, or a second income stream.

The following offices provide assistance to small businesses in California:

California Office of the Small Business Advocate (CalOSBA) – supports economic growth and innovation for all California small business, entrepreneurs, and startups by providing information and direct support they need to better navigate resources, programs, and regulations.

California State Trade Expansion Program (STEP) – provides funding and assistance to California small businesses that aim to initiate or expand their export activities.

Community & Place-Based Solutions – California’s clearinghouse for comprehensive community and economic development technical resources and regional assistance. Individuals can search funding opportunities, data sources, and more.

What taxes are imposed on businesses by the state of California?

California imposes three types of income taxes on businesses: a corporate tax, a franchise tax, and an alternative minimum tax (AMT). Nearly all businesses in the state are subject to at least one or two of these taxes.

- Corporate income tax applies to corporations and LLCs that elect to be treated as corporations. This tax rate is a flat 8.84%, which is higher than the US average. It applies to net taxable income from business activity in California.

- Alternative Minimum Tax (AMT) – Corporations do not pay franchise tax, but pay an AMT of 6.65%. The AMT is based on federal AMT rules, applying to C-Corporations and LLCs that elect to be taxed as corporations. This tax prevents corporations from writing down income to minimize corporate tax.

- Franchise tax applies to S-corporations, LLCs, LPs, and limited liability partnerships (LLPs). Additionally, C-corporations that do not have positive net income pay the franchise tax instead of the corporate tax.

Does having a California address trigger a business tax?

Having an address in California does not automatically trigger a business tax. The tax obligations for a business in California are primarily based on its activities and the type of entity it is, rather than solely on the address. However, establishing a physical presence in California, such as having an office or a retail location, can potentially create nexus, which means the business has a connection or a substantial presence in the state. Nexus can trigger tax obligations, including income tax, sales tax, and other business-related taxes.

How much is the minimum Franchise Tax in California?

Immediately upon registering with the California Secretary of State, until the business applies for and is granted a tax exemption, all corporations, including nonprofit corporations, LLCs, LPs, and LLPs are all subject to pay an annual minimum franchise tax of $800 to the California Franchise Tax Board. The annual minimum franchise tax continues to apply until termination documents for the business are filed with the Secretary of State.

Failure to file a return by the original or extended due date may result in a penalty.

Does California state tax SaaS income and online marketplace?

California generally does not require sales tax on Software-as-a-Service purchases. Software purchased via the Internet where the customer does not receive a hard copy or take possession of the software is not considered tangible personal property. However, if tangible media is transferred to the customer, the sale is taxable. Transfers of software or information by electronic means are not taxable.

How do I close my California business entity?

Business entities doing or transacting business in California or registered with the California Secretary of State can dissolve, surrender, or cancel when they cease operations in California and need to terminate their legal existence here.

- Domestic corporations (those originally incorporated in California) may legally dissolve.

- Foreign corporations (those originally incorporated outside California) may legally surrender.

- LLCs and partnerships (both domestic and foreign) may legally cancel.

Dissolving, surrendering, or canceling a California business entity is a multi-step, multi-state agency process that has requirements with the California Franchise Tax Board and the California Secretary of State.

What are the closure Requirements for the California Franchise Tax Board?

In order to close the business properly, the entity must first cease doing business, as obvious as that sounds. Any income the business receives AFTER the business is dissolved and final taxes are filed, require additional filings that complicate matters more.

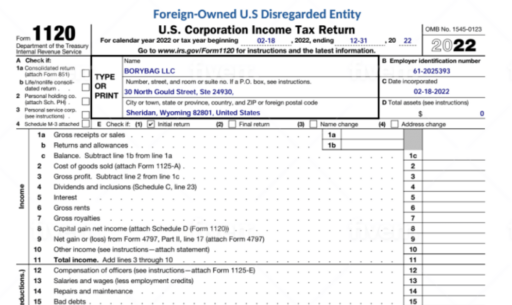

After filing for dissolution, file all delinquent franchise returns and pay any tax or penalties due. The company must also file the final year tax return in the year it dissolved. All Final Returns must have the Final Return box on the first page checked, and “FINAL” at the top of the first page to clearly mark it as such.

What are the closure Requirements for the California Secretary of State

The business must file the appropriate forms with the California Secretary of State within 12 months of filing the final State tax return, though it is recommended to do that shortly after dissolution.

Businesses that are suspended or forfeited will need to be made in good standing before being allowed to dissolve. To revive a suspended or forfeited business, the company must file any delinquent tax returns, pay all delinquent taxes and penalties, and then file a revivor request form.

Can Cleer help me with my California Income Tax?

YES! Every Cleer corporate Income Tax Package includes BOTH Federal and State (1 included in package) income tax filings.

Cleer provides accurate, affordable, and efficient financial and tax services for U.S. businesses and subsidiaries to help entrepreneurs do it right from the start. We also offer all-inclusive monthly accounting packages that include monthly statements as well as your federal and state tax returns. If you have any other questions about forming your company or how to maximize your tax savings, book a consultation to discuss the best structure for your startup business, regardless of which state you register in. We also provide a new company package that includes a tax consultation, bookkeeping, and a chart of accounts set up to help you do it right from the start.