Introduction to the West Virginia Corporate Tax Rate:

West Virginia, a relatively small and sparsely populated state, might not be the top choice for starting a business, particularly if you’re looking for a business-friendly state. According to CNBC’s “America’s Top States for Business in 2022” report, the state ranked 49th in the categories of business friendliness, technology, and innovation. It also landed in the bottom ten for workforce and infrastructure. However, despite these challenges, there are some silver linings.

One notable advantage is West Virginia’s lower cost of living than many other states, which can significantly benefit small business owners and their employees. The state has also taken steps to reduce business taxes in recent years by lowering the West Virginia corporate tax rate on income and eliminating the business franchise tax. If you’re considering starting a business in West Virginia, it’s essential to understand the tax implications, such as the 6.5% West Virginia corporation tax rate on net income and the phased-out franchise tax. Tax reforms like reducing the state’s income or tangible property taxes would make the state more attractive to individuals looking to conduct business.

Read the rest of this in-depth guide to learn everything you need to know about the West Virginia corporate tax rate.

Key Takeaways:

- West Virginia does not have a franchise tax.

- The West Virginia corporate tax rate on income is 6%, while individuals are subject to a progressive tax system with rates ranging from 2.36% to 5.12% of taxable income.

- West Virginia levies a 6% sales tax, and localities can add up to 1%. The average combined sales tax rate is 6.566%.

- It has a lower cost of living than many other states, which can benefit small business owners and employees.

How Do I Start a Business in West Virginia?

When starting a business in West Virginia, this 7-step process must be followed:

- Determine the business structure in line with your objectives and tax strategy.

- Apply for an Employer Identification Number (EIN).

- Register your business with the state agency or agencies relevant to your industry.

- Obtain the required certifications, licenses, or permits through the Division of Labor.

- Comply with insurance requirements.

- Know your employer’s responsibilities.

- Identify regulations applicable to your company, as some businesses may require additional licensing and permits.

To learn more about starting a business in West Virginia, visit the WV One Stop Business Portal.

What Is the West Virginia Corporate Tax Rate on Income?

The West Virginia corporate tax rate on net income is relatively low, currently standing at 6.5%. Companies incorporated or doing business in West Virginia may have to file an annual West Virginia corporation tax return. For individual taxpayers, it has a progressive tax system with income tax rates ranging from 2.36% to 5.12% depending on their taxable income.

Does West Virginia Have a Franchise Tax?

The state phased out the franchise tax for tax years beginning on or after January 1, 2015.

Does Having a Mailing Address in West Virginia Trigger Corporate Income Tax and/or Registration Requirements?

A mailing address in West Virginia doesn’t necessarily trigger the requirement to pay the West Virginia corporate tax rate on income. Corporate net income tax applies to companies registered in West Virginia or generating income from property, activities, or other sources within the state. Such entities must register with the Secretary of State and the Tax Division before commencing any commercial operations within the state.

Will I Pay Taxes If I Have My Business in West Virginia But Live in a Different State?

Companies in West Virginia must file a state tax return and pay the West Virginia corporate tax rate if they conduct business and earn income within the state. Keep in mind that the company must be registered with the Secretary of State and the Tax Division before conducting any business in the state. If you do not live in West Virginia, you are only required to file a state tax return and pay the West Virginia corporate tax rate if your federal adjusted gross income includes income from the state, such as earnings from a business there.

All My Activities Are Outside the U.S., and I Live in Another Country But Have a Company in West Virginia. Do I Have to Pay Taxes There?

When a company is formed in West Virginia, it may be required to file a corporate tax return, even if its operations are outside the United States. If the company is registered in a state other than WV, it may not need to file a corporate tax return in WV.

Does Having an Employee in West Virginia Trigger Corporate Income Tax?

While West Virginia’s nexus is broad, the state does not specify whether having an employee in the state requires businesses to file income tax. However, if the company is deemed to generate income in the state or is incorporated there, it may be necessary to file income tax returns. In the Tax Commissioner v. MBNA Amercia Bank, N.A. case, the West Virginia Supreme Court of Appeals upheld income tax enforcement against MBNA despite the company having no employees or other tangible ties to the state.

The ruling established that a “significant economic presence test” is a more suitable criterion than a physical presence standard for determining whether a company has a substantial connection with the state to be subject to corporate income tax. This implies that the determination of whether a company is subject to income tax extends beyond the mere physical presence of the company and considers its economic activity within the state.

Does Having an Independent Contractor in West Virginia Trigger the Requirement to Pay the West Virginia Corporate Tax Rate?

The state is very clear about the tax filing triggers for businesses that generate income in West Virginia or are registered there. There are no specific instructions for companies with independent contractors in states requiring corporate income tax filing.

Does Having a Founder Living in West Virginia Trigger Corporate Income Tax?

Since the tax nexus doesn’t specify that having a founder living in West Virginia may trigger state tax filing in the said state, it is safe to say that the business is not required to pay the West Virginia corporate tax rate in the WV if a founder lives in the WV.

If You Hold Board Meetings in West Virginia, Will It Trigger the Requirement to Pay the West Virginia Corporate Tax Rate?

Having a board meeting in West Virginia generally does not trigger the requirement to pay the West Virginia corporate tax rate on income for an out-of-state company. The business may be required to file taxes in the state, not because of board meetings held in the state but because it conducts business in the state and generates revenue from WV.

Is There a Sales Tax in West Virginia?

All sales are presumed to be subject to a 6% sales tax, except for prescription drugs, grocery items, and foodstuffs. Agricultural products and equipment used in farming, medical services, and Internet sales are not taxed. Additional taxes of up to 1% may be imposed by local governments. The average combined sales tax rate is 6.566%.

Does West Virginia Tax SaaS Income?

SaasS products are subject to sales and use tax in West Virginia. Computer-related products, such as pre-written computer software, non-prewritten computer (custom) software, and related mandatory and optional computer software maintenance, are subject to sales tax in West Virginia. However, digital products “transferred electronically,” streaming or downloaded, such as movies and video, digital books, and digital audio works such as music, are exempt from sales taxes.

Does West Virginia Tax Online Marketplaces?

State and municipal sales and use taxes must be collected by remote sellers on sales delivered within West Virginia. Remote sellers selling tangible personal property and/or services for delivery in WV who do not have a physical presence in WV should collect sales and use taxes in WV.

They need to register before they can collect sales and use taxes. Registration can be done on the West Virginia Tax Division website or with the Streamlined Sales Tax Governing Board.

Remote sellers with fewer than 200 sales transactions for delivery in WV or sales of $100,000 or less in WV are exempt from sales and use tax collection. Sellers with a West Virginia physical address or who voluntarily collect taxes for the state are not eligible for the small-seller exception.

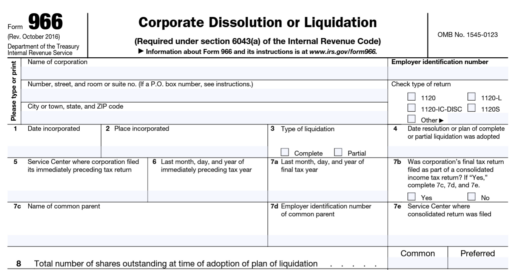

How Do We Dissolve Our Business in West Virginia?

Businesses formed or qualified through the Secretary of State’s Office must also apply with the Secretary of State’s Office to dissolve, terminate, withdraw, or cancel their operations in the state. Use the One Stop Business Portal to quickly and conveniently file for dissolution, termination, withdrawal, or cancellation. The Secretary of State’s office also provides forms that meet minimum state law requirements and are available online via the Secretary of State Form Search.

When is the West Virginia State Tax Return Due?

State corporate taxes are due on the same date as federal taxes: the 15th day of the fourth month following the end of the tax year, usually April 15th. See the schedule below for other entity types.

| Form of Business | Due date |

| C-corporation with Calendar Year | Filing Deadline: April 15 Extended Due Date: October 15 |

| C-corporation with June 30 Year-End | Filing Deadline: October 15 Extended Deadline: April 15 |

| C-corporation with Fiscal Year-End other than June 30 Year-End | Filing Deadline: 3 ½ months after the company’s year-end Extended Deadline: 6 months after the original deadline |

| S-corporation | Filing Deadline: March 15 Extended Deadline: Six Months after the original deadline |

| Partnership | Filing Deadline: March 15 Extended Deadline: Six Months after the original deadline |

| Composite Returns | Filing Deadline: April 15 Extended Due Date: October 15 |

| Fiduciary Return | Filing Deadline: April 15 Extended Due Date: September 30 |

Is There a Penalty for Filing my West Virginia State Tax Return Late?

Late Filing Penalty: Late filers incur a 5% penalty per month or any part of the month on any amount of the total taxes owed after the tax return deadline, capped at 25%.

Late Payment Penalty: Until the tax debt is paid after the tax return deadline, late payments will incur an additional penalty of 0.5% per month, or any portion of the month, on any amount of your total taxes owed, capped at 25%.

Can Cleer Tax Assist with Filing My West Virginia State Tax Return?

Absolutely! Cleer Tax offers consultations to discuss the best structure for your startup business, no matter what state you register in. We provide a new company package that includes a tax consultation, bookkeeping, and a chart of accounts set up to help you do it right from the start and ensure you are paying the correct West Virginia corporate tax rate.

Our federal income tax preparation packages include your state tax as well. We also offer all-in-one monthly accounting packages that include monthly statements plus your federal and state tax returns.

If you have any questions or need additional help finding the right package, email us at hello@cleer.tax.