Thinking about launching a business in Montana? Get ready for a business-friendly journey. You’re in for some tax perks! Montana tax rates rank fifth in the 2023 State Business Tax Climate Index, owing to the absence of state and local sales and franchise taxes. And guess what? Montana’s tax system, thriving entrepreneurial community, and other tax benefits are so appealing and tempting for small businesses that many California residents are trading beach vibes for Montana’s low taxes and affordable living costs. So, whether you are starting your own business or simply curious about the tax scene in Montana, this article is your ultimate guide to everything you need to know about Montana tax rates.

Key Takeaways

- Montana ranks 5th overall on the 2023 State Business Tax Climate Index.

- The state is recognized as one of the most business-friendly in the U.S., ranking 4th in CNBC’s “America’s Top States for Business 2023.”

- Montana experienced significant entrepreneurial growth in 2021, with over 51,500 new businesses registering and showcasing a thriving business landscape.

- Starting a business in Montana requires registration with the Secretary of State and obtaining the necessary licenses and permits.

- Montana imposes a 6.75% corporate income tax but does not have a franchise tax.

- Montana does not charge state or local sales tax.

- Montana has a graduated individual income tax that ranges from 1% to 6.75%. Montana has a progressive individual income tax system with rates varying from 1% to 6.75%.

Is Montana a Business-Friendly State?

Montana is one of the most business-friendly states in the United States, ranking fourth on CNBC’s “America’s Top States for Business 2023.” It is known for having a relatively low level of government regulation compared to some other states, which may be appealing to businesses. Montana tax rates also rank fifth overall on the 2023 State Business Tax Climate Index, owing to the relatively low state taxes. It has long been recognized as a prime destination for business startups.

In 2021, Montana saw an impressive increase in entrepreneurial activity, with over 51,500 new businesses registering with the Montana Secretary of State. This figure surpassed the previous record set in 2020 by more than 12,000 companies, indicating a robust economy and a thriving entrepreneurial community. No wonder many California residents are willing to trade their lives near the beach to live in Montana – they can save on taxes, and the cost of living is reasonably low. Montana has a skilled workforce in certain industries, particularly those related to agriculture, tourism, energy, and technology. However, the availability of skilled labor may vary depending on the location and industry.

What Do I Need to Do to Start a Business in Montana?

To start a business in Montana, you must register with the Montana Secretary of State. Even though business regulation is somewhat lighter at the state level compared to some other U.S. states, Montana still requires nearly every business to obtain some business licenses. The state government may not have any general licensing requirements. Still, different specialty licenses may apply to your business, depending on your business structure and industry.

Here are the general guidelines for forming a new business entity in Montana:

- Determine your business structure. You may choose any common business structure (sole proprietorship, partnership, limited liability company, or corporation). Remember that your company’s business structure affects your tax obligations, filing requirements, and personal liability. Consulting with tax accountants, lawyers, or business counselors is highly recommended.

- Choose your business and check if it is still available through this link.

- Protect your assumed business name by registering it with the proper agencies using the Montana Secretary of State website.

- File formation documents with the Montana Secretary of State’s Office.

- Apply for federal and state tax identification numbers.

- Visit the Montana Department of Revenue website to determine the business’s licensing requirements.

- Apply for licenses and permits.

- Open a business bank account.

- Determine tax obligations and set up withholding records.

Visit Montana’s official state website for the business start-up recommendation checklist, related links, and other important information about launching a business in Montana.

Does Montana Have a Corporate Income Tax?

Montana has a progressive tax system for individuals with rates ranging from 1% to 6.75%, while the corporate income tax rate is 6.75%.

Is There a Franchise Tax in Montana?

Montana does not levy a franchise tax on businesses that operate within the state.

Will I Be Required to Pay Montana Tax Rates if I Own a Business in Montana but Reside in Another State?

Even if you are a nonresident of Montana, you may still need to pay the Montana tax rates on income if you received income from Montana sources, for example, from your company engaged in business in Montana. Nonresident taxpayers must file a Montana income tax return if gross income attributable to state sources exceeds the return filing threshold.

All My Activities are Outside the U.S. and I Live in a Different Country but Have a Company in Montana. Do I Have to Pay Montana Tax Rates?

Suppose you are a nonresident and conduct all of your activities outside of the United States without receiving any income from sources in Montana, including your Montana-based business. In that case, you are not subject to taxation. Similarly, your company in Montana is only subject to a 6.75% corporate income tax on its total Montana net income.

To ensure compliance, it is crucial to confirm that you are not considered a resident of Montana for tax purposes during the tax year. Being a Montana resident means being taxed on all income, including out-of-state earnings. Generally, you are considered a resident if you are domiciled or maintain a permanent place of abode in Montana. However, there are various factors that determine whether a person is domiciled or holds a permanent place of abode in Montana. These include, but are not limited to:

- Holding a Montana driver’s license or ID card

- Having a Montana resident hunting or fishing license

- Where an individual registers their motor vehicles

- Property ownership, rental, or occupancy within Montana during the tax period

- Mobile home or a recreational vehicle with sleeping and cooking arrangements

- Where the individual regularly receives their mail

- The location of an individual’s principal place of business, profession, or occupation

Does Having an Employee in Montana Trigger Corporate Income Tax?

If a company hires someone who lives in Montana, there are state income tax consequences for both the worker and the employer. The worker is generally subject to paying Montana tax rates on income as either a Montana resident or an earner of Montana-sourced income for the time the employee worked in Montana as a nonresident or part-year resident. However, the company for which the worker is employed may also be subject to paying Montana tax rates on income, even if the company has no physical presence in Montana.

Does Montana Collect Sales Tax?

Montana does not collect general sales tax but has an “alternative gross sales tax” of 0.5% on sales. To be subject to this tax, a corporation must:

- Have only sales activity in Montana,

- Not own or rent real estate or tangible personal property, and

- Have annual gross sales in Montana of $100,000 or less.

Does Montana Tax SaaS Income?

Software as a service (SaaS) is not taxable in Montana.

Does Montana Tax Online Marketplaces?

Montana does not have state and local sales tax, so the answer is NO.

Does Montana Tax Remote Software Sales?

No, Montana does not tax remote software sales. Out-of-state businesses are not required to collect sales tax from Montana residents because the state has no sales and use tax.

What Will I Have to Do if I Want to Close My Business in Montana?

To cancel, withdraw, or terminate your business registration in Montana:

- Visit the online filing portal of the Montana Secretary of State.

- Sign in with your username and password. If you don’t have an account, create one.

- Use the search feature to find the business registration.

- Click on the business name and locate the panel on the right side of the screen.

- Choose the applicable form from the Filing Actions button (e.g., dissolution, withdrawal, termination, cancellation).

- Complete the online application, ensuring all fields with a red asterisk are filled.

- Review all instructions and use the Question Mark icon for more field information.

- Submit the application by clicking “FILE ONLINE.”

- You will get an email after your application is accepted with directions on how to download confirmation documents from your account.

To properly close your Montana-based business, you must also:

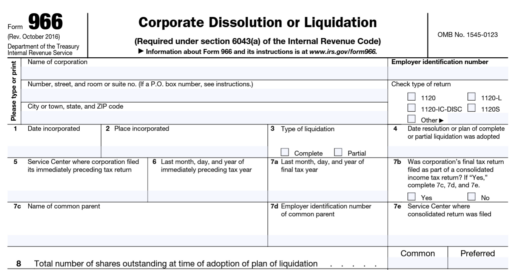

- File Final Returns: Ensure you file a final return for the year you close your business, marking the “final return” box on the form. The specific forms required will vary based on your business type. If you operate as a C-corporation, file Form 966, Corporate Dissolution or Liquidation.

- Pay Taxes Owed: Clear any outstanding tax obligations associated with your business.

- Cancel EIN and Close Your IRS Business Account: To request closure of your Employer Identification Number (EIN) and your IRS business account, send a letter to the IRS indicating your business’s complete legal name, EIN, address, and the reason for closing the account.

- Keep Records: As per the law, keep all business records until the statute of limitations expires. This ensures you have documentation for tax purposes and potential future inquiries.

When is My Montana State Tax Return Due?

You must file your Montana corporate income tax return by May 15 if you are a calendar-year taxpayer or the 15th day of the 5th month following the fiscal year end if you are a fiscal-year taxpayer. Montana grants all C-corporations an automatic six-month extension to file a return. No application is required to obtain an extension. If the due date falls on a weekend or holiday, the return is due on the next business day.

Are There Penalties for Not Filing Income Tax or Filing Late in Montana?

In Montana, you’ll face a penalty if you miss the tax filing deadline (including extensions). This penalty is calculated as the greater of $50 or 5% of the tax owed for each month of delay, with a maximum penalty of 25% of the tax owed. It accrues from the extended due date until the department receives the tax return. For pass-through entities, intentionally or knowingly filing taxes late incurs a penalty of $1,000.

Can Cleer Tax Determine If I Need to Pay Montana Tax Rates on My Income?

YES! Every Cleer Corporate Income Tax Package includes BOTH federal and state income tax filings. If you do business in more than one state, each additional state is only $175.

Cleer Tax provides accurate, affordable, and efficient financial and tax services for U.S. businesses and subsidiaries to help entrepreneurs do it right from the start. We can help you determine whether paying Montana tax rates is necessary for you or your business. We also offer all-in-one monthly accounting packages that include monthly statements as well as your federal and state tax returns.

If you have any other questions about forming your company or maximizing your tax savings, book a consultation to discuss the best structure for your startup business, regardless of which state you register in. We also provide a new company package that includes a tax consultation, bookkeeping, and a chart of accounts set up to help you do it right from the start.

For more information about our services or Montana tax rates, visit our pricing page or email customer success at hello@cleer.tax.