Expert tax and bookkeeping support for businesses who want to stay tax compliant and grow faster.

With 5,000+ clients strong, we’re experts in tax compliance, making it pain-free and within reach.

Your whole life has been about this —getting your company from startup, to funding, all the way to (fingers crossed!) exit.

Now, if you want to stay compliant with the IRS, you need reliable experts to help you navigate the complexities of U.S. tax laws. Not only are our accountants IRS Enrolled Agents, but they also have years of experience working with business owners around the world.

At Cleer Tax, we’re more than just a service provider – we’re your dedicated long-term accounting partner.

Our team of experienced book keepers and accountants provides tailored support to help you grasp the ins and outs of your business and tax compliance.

Say goodbye to generic responses and one-size-fits-all tax returns. With a dedicated team handling all your accounting requirements, you’ll experience the personalized attention and expertise that make it feel like you have your very own in-house accounting department working tirelessly for your business.

To be successful, you need to think ahead. You need us to think ahead for you.

We identify the most effective tax optimization strategies that will not only boost your growth now but fuel your growth for years to come.

While tax and bookkeeping may not be traditional centers for growth, our transparent, flat-fee pricing makes it easy to get back more than you put in. We aim to support you, not shorten your runway. Because more overhead is a risk to your success, and we’re here to help you grow.

Plus, our extensive experience ensures you file all the right paperwork, on time, and pay the least amount possible to stay compliant.

For over half a decade, helped entrepreneurs take care of their books and taxes.

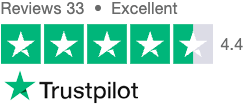

Thousands of startups, small, and growing businesses choose Cleer as their trusted financial partner.

Teams from all over the world have used our accounting services to accelerate growth.

Our tax pros can assist C-Corps, S-Corps, and LLCs incorporated in states across the U.S.

We’ve created this handy widget to keep track of important business tax deadlines for your startup that you can automatically add to your calendar. Get your…

Cleer Tax provides flat-rate accounting services for U.S. startups, often with foreign ownership, and growing businesses, to do it right from the start. Our all-inclusive accounting packages provide tax preparation, and bookkeeping to fit any budget and growth stage. Our tech-forward, streamlined process provides the Cleer path to success for your startup.

© 2024 Cleer Tax, LLC. All Rights Reserved · Privacy Policy · Terms & Conditions · Website by ModernTraction.com